Among tax shields for wealthy individuals and families, 1031 exchanges hold a time-honored status. By reinvesting the proceeds of a real estate sale into a like-kind property, you can delay paying capital gains taxes on it for a very long time – theoretically, forever.

At some point, though, you might want to actually realize that capital gain – trade in that growing portfolio for a robust cash stream. That’s where the Section 721 Umbrella Partnership REIT comes into play. While 1031 exchanges allow deferral of capital gains, at some point, investors may want to transition to a more liquid, diversified structure. An UPREIT enables you to convert your property into operating partnership units, which we’ll explain in a moment. This switchover not only monetizes your holdings, but it puts an end to the constant paperwork and reporting requirements of the 1031 exchange game.

But is that all there is to UPREITs? Are they just the last link in your chain of 1031 exchanges once you choose to retire from actively managing your own real estate holdings? Or are there other use cases for them? We believe there are.

To find those use cases, though, let’s first review how UPREITs work, what favorable tax treatment they convey and who stands to benefit most from employing them.

REITs have been around since 1961, but it wasn’t until 1992 that OP units were enabled by federal statute. That would be the previously referenced Section 721 of the applicable part of the Internal Revenue Code: “No gain or loss shall be recognized to a partnership or to any of its partners in the case of a contribution of property to the partnership in exchange for an interest in the partnership.”

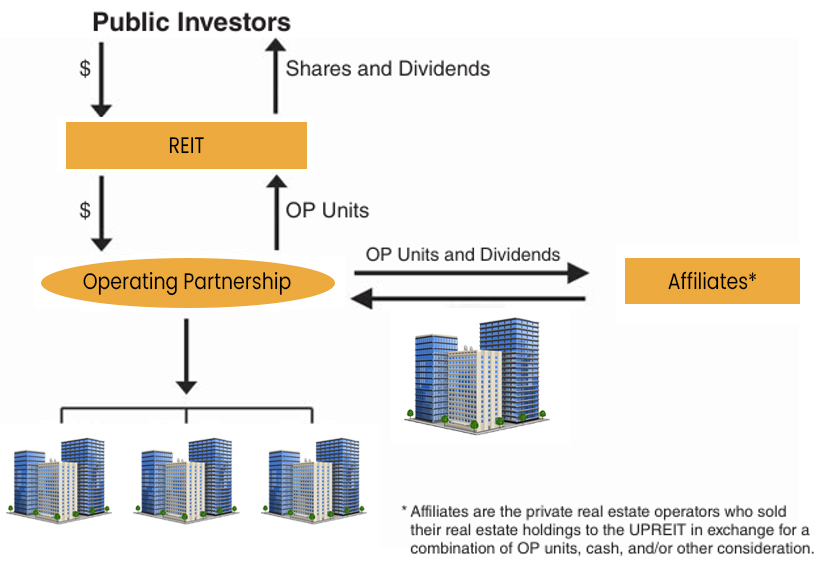

OP units are ownership interests in the operating partnership of a REIT, which function similarly to shares but have different liquidity and tax characteristics. In other words, they are proportional ownership interest in the operating partnership, as opposed to the REIT itself.

UPREITs differ from traditional REITs in two ways, according to REIT guide author Stephanie Krewson-Kelly. An UPREIT is a REIT that holds its properties through an operating partnership (OP) structure. This allows property owners to contribute real estate tax-deferred in exchange for OP units, instead of selling for cash.(The OPs are called “umbrella partnerships” by regulators, thus the UP in UPREIT.) Second – and this is the key point of distinction for many investors UPREITs can acquire property by exchanging OP units as well as through cash or common stock.

These structures look like this:

In this picture, you’d be one of the affiliates off to the right – those who sold their real estate holdings to the UPREIT. OP units are the usual currency of exchange because of their tax advantages; such a transaction is considered tax-deferred under Section 721, so the property owner need not immediately pay capital gains taxes on the property transfer. Still, you might elect to take a portion in cash or other consideration. Consult a tax professional to understand how these tax implications may apply to your situation

To become an affiliate, you must contribute your property. As with any real estate transaction, it’s a negotiation and the usual advice applies. This starts with knowing the value of the property you hold via market analysis and appraisal. But that’s the easy part; you’ve probably done it a hundred times. But you were doing it for cash, and OP units are most certainly not cash.

First of all, OP units are far less liquid, and it’s your job to figure out just how much less liquid and discount their value accordingly. If the UPREIT has a mandatory lockup period, that’s a need-to-know. Kiplinger’s reports that such is the norm, and these periods typically run from 12 to 24 months.

And don’t assume a listing on a major stock exchange is irrevocable.

“Because the [UP]REIT could be delisted from the exchange on which [its] Shares are traded, there might be little or no liquidity for the … Shares issuable upon exchange of redeemed OP Units,” cautions a panel of partners from the century-old law firm Vinson & Elkins.

The V&E partners further cautioned that liquidity could be reduced even further “due to insider trading prohibitions or the short swing profits rule of Section 16 of the Securities Exchange Act of 1934”. In a nutshell, that means if you end up with 10% or more of the UPREIT’s equity or accede to the board or top management team, you can’t reverse your exposure to the company for six months, according to the National Association of Stock Plan Professionals.

You should also be aware of when OP units can be – or must be – converted into publicly traded REIT shares, and what the formula for that conversion would be; typically it’s 1:1, but you should nail that down. This lack of liquidity, though, is a feature rather than a bug. It’s what makes the IRS receptive to the idea of deferring the capital gains; if you could easily trade OP units, the tax authorities would be more likely to consider it a cash-equivalent deal and require you to realize your gain. The longer you hold OPs as opposed to REIT shares, the longer your investment remains tax-shielded. Again, you should consult a tax professional to understand how all this may apply to your unique situation.

Second, while you hope and expect them to appreciate relative to cash, there’s no guarantee that they in fact will. You’ll need to quantify the degree of risk you’re taking because your participation with this UPREIT will likely outlive you and be passed down to your inheritors.

Nor are OP units entirely analogous to shares of stock. While they are economically similar, they don’t automatically convey any voting rights. In this way, they’re more like limited partnerships than like other REITs. If you’re accustomed to having a say in the governance of your property, you might want to bear this in mind as you negotiate.

There’s a twist on the UPREIT you should be aware of. Someone with a love of either wordplay or quantum physics named it the DownREIT. These were typically a legacy REIT that wanted to convert to an UPREIT structure but found it too costly or complicated. Instead, it would become a DownREIT by acquiring the portfolio of one specific affiliate and managing it separately from the rest of its assets. This allows these more established REITs to compete with UPREITs as they strive to acquire new properties.

A DownREIT, then, is a facility through which a REIT assists real estate owners in retaining control of their current real estate. According to academic site WSO, investors can negotiate for the REIT to agree to a standstill or lockout agreement once it’s time to sell the contributed assets.

The immediate benefit of an UPREIT is the steady cash flow. Rather than the boom and bust of the real estate market, you now get to kick back and get your distributions, typically on a quarterly or monthly basis. That’s actually a benefit of UPREITs over 1031 exchanges, which you have to keep juggling to defer taxes on your capital gains.

Speaking of tax deferral, that is of course the next important benefit of an UPREIT. Once you transfer your holdings to the OP, the arrangement protects your capital gains as long as you hold OP units rather than REIT shares. This is much the same arrangement as a 1031 exchange, through which you reinvest the proceeds of the sale of your assets and buy fractional equity shares of a Delaware statutory trust, which owns and operates its own properties. As always, a tax professional is best positioned to help you understand how the implications for your own situation.

DSTs are also frequently used in tandem with UPREITs, again according to Kiplinger’s, particularly some DSTs allow investors to transition into an UPREIT through a 721 exchange, but the timing varies. Many REITs enforce a multi-year lock-in period before allowing this conversion. Essentially, the DST-to-UPREIT path boils down to a three-step process:

This path ensures that the like-kind rules are scrupulously followed. It also enables real estate investors with a modest portfolio to rinse-and-repeat until they have accumulated enough to make a 721 exchange worthwhile; that’s typically somewhere around $30 million in assets.

One main difference between an UPREIT and a DST is that the UPREIT tends to offer much greater diversification. You are essentially commingling your holdings with those of other investors in similar situations. This of course minimizes the risk of the overall portfolio. DSTs tend to be the ownership and management structure of a single property or tight cluster of properties.

Another difference is liquidity. Again, the only reason why either of these options is tax-advantaged is because they are by nature illiquid. That said, at least OPs can be converted into UPREIT shares, which are readily tradable. Ideally, you wouldn’t want to make that conversion during your lifetime but, once your legacy has been passed forward, each beneficiary can decide individually whether or when to cash out.

Estate planning is very much part of an UPREIT’s appeal. To start with, OPs or UPREIT shares are a lot more fungible than property deeds. Further, your heirs’ tax basis for the assets would be their fair market value on the day of your passing rather than their value on the day you entered into the 721 exchange. Assuming the assets appreciated, that’s a tax advantage you can leave to your loved ones – the degree of which is best left to a tax professional to calculate.

And let’s not forget the reason for any investment: returns. Even before the tax shielding, an UPREIT ought to present superior financial benefits to your standalone real estate investment. You should also consider fees and commissions; UPREITs tend to be more efficient than DSTs, but there’s no guarantee. If the vehicle you’re contemplating has not historically outperformed both before and after tax and fee considerations, that might be a signal to choose a different one.

You can’t outrun the IRS forever, just until you die. When you or your inheritors convert your OPs into UPREIT shares, you must pay taxes on those capital gains.

You might incur other taxation. First, your distributions will be taxed as regular income. While you might not be crazy about the idea of paying 20% of your windfall upon realizing your capital gain, let’s remember that the distributions will probably be levied at a higher rate. You won’t experience the same sticker shock because the income will be spread out over years, but we shouldn’t fool ourselves.

There may be a way out, though. OP or UPREIT distributions may be classified as a return of capital, deferring immediate taxes. However, this reduces the tax basis of OP units, potentially increasing capital gains taxes when they are eventually sold.

If your net worth is greater than around $14 million – and, if you’re looking at UPREITs, it probably is – you face the spectre of the estate tax. Unless you’re survived by an inheriting spouse, your estate will get hit with a 40% marginal tax rate. Suddenly, the 20% rate of the capital gains tax doesn’t look so usurious, but you should get the opinion of a tax professional when making such comparisons relative to your own portfolio.

As we discussed before, you lose direct control over your property when you enter into a 721 exchange, but that is not, strictly speaking, an economic imposition. More critical is the market risk. You went into real estate in the first place because it has such a strong tendency to appreciate in value, but nothing is for certain. There is always market risk. Not only could you find yourself selling into a recessionary environment, the underlying properties could become less valuable. Even if the land itself constantly rises in value, the buildings occupying it are constantly depreciating in both accounting and real-world terms. There’s no guarantee that the OP units you traded your property for will mature into even more valuable UPREIT shares.

UPREITs are, of course, subject to the same stresses as any other business, so you should pay particular attention to its debt. A high debt-to-equity ratio, above-average exposure to variable interest rates and a tendency to borrow money to pay distributions are all red flags.

Let’s also not lose sight of the cost of doing business.

Finally, there’s “finally”. The UPREIT is the end of the road for deferring capital gains. There are no more like-kind exchanges to be made once you pull the trigger on a 721 and transfer your holdings directly into an UPREIT. If you’re closer to the beginning or middle of your real estate career, this probably isn’t for you.

So who is it for?

Before we answer that question, let’s be clear on one thing: You shouldn’t do anything based on one thought leadership article you saw on the internet. That advice goes well beyond investing for capital gains deferral. No matter your personal finance goals, the only firm advice we’re prepared to give you is to talk to someone who gives firm advice on personal finance goals for a living.

That said, the profile of an investor who should consider a 721 exchange is generally a seasoned real estate investor who is seeking to spend less time at work and more time at leisure. This person might also be of an age at which estate planning is becoming an increasingly important consideration – someone who wants to make life a little easier for the inheritors. The intention is that each heir should receive liquid assets rather than real property so they can each monetize their inheritance at their own convenience.

It practically goes without saying that this investor has a high net worth and is seeking a tax-efficient exit strategy for appreciated properties.

While 721 exchange volume and value comparisons are difficult to track over time – nobody has a duty to report them – a wide array of sources suggests that the pace is quickening rather than slowing. That’s impressive, especially considering the bang UPREITs started out with.

“A total of nine equity REITs had held initial public offerings (IPOs) in the United States in 1991 and 1992, the beginning stages of the Modern REIT Era. Yet, in 1993 alone, 44 equity REITs went public,” according to the industry group Nareit. “What changed in that one particular year? [OP units] and the expansion of the UPREIT structure came into vogue.”

The Nareit article goes on to say that the 721 exchange was invented in response to the extraordinarily tight lending restrictions that followed in the wake of the late 1980s’ savings-and-loan crisis.

“I was told by one banker that if you brought in cash as collateral equal to the amount you wanted to borrow, you still couldn’t get a loan … The scrutiny on real estate exposure was that strong,” one Taubman Centers executive told Nareit.

Still, that doesn’t explain the rapid drumbeat of new 721 exchanges today. We need to look at the broader economy to understand this better.

So perhaps the real reason why we’re seeing such a surge of interest in 721 exchanges today is that they’re necessary – not just for the affiliates, but for the general partnerships themselves.

Given current economic conditions, REITs may increasingly turn to private property owners as sources of capital, making UPREIT structures an attractive option for both investors and sponsors. They should not expect to do it out of a sense of public virtue. Rather, the firms that operate UPREITs – and DSTs for that matter – may benefit from seeing these private affiliates as dependable, flexible sources of the capital which they need to expand and modernize their portfolios.

And these affiliates, as wellsprings of resources needed to fuel the real estate market through what could be some narrow straits, may present strategic opportunities for both investors and REIT sponsors.

Sources:

https://bin.ssec.wisc.edu/ABI/kaba/REIT/ch6.pdf

https://www.kiplinger.com/real-estate/deferring-taxes-with-a-721-exchange-pros-and-cons

https://media.velaw.com/wp-content/uploads/2019/11/28180433/c14d6fbb-276d-49e3-889b-16930b4e1945.pdf

https://www.govinfo.gov/content/pkg/COMPS-1885/pdf/COMPS-1885.pdf

https://www.naspp.com/blog/section-16(b)-the-short-swing-profit-rule

https://www.wallstreetoasis.com/resources/skills/finance/upreit-vs-downreit

https://www.irs.gov/businesses/small-businesses-self-employed/estate-tax

https://www.reit.com/news/reit-magazine/november-december-2013/open-business

Investing in alternative investments may be speculative, illiquid, and not suitable for all clients. They are intended for investors who meet certain criteria and are willing and able to bear the unique economic risks of the investment. Investors should consider whether such investments are suitable in the light of their individual financial situation.

Perch Financial LLC and Arkadios Capital LLC do not provide legal or tax advice. Securities offered through Arkadios Capital LLC Member FINRA/SIPC and MSRB registered. Arkadios Capital LLC is unaffiliated with any entity herein.

1031 Risk Disclosure:

No offer to buy or sell securities is being made. Such offers may only be made to qualified accredited investors via private placement memorandum. Risks detailed in a private placement memorandum should be carefully reviewed, understood, and considered before making such an investment. Prospective strategies and products used in any tax advantaged investment planning should be reviewed independently with your tax and legal advisors. Changes to the tax code and other regulatory revisions could have a negative impact upon strategies developed and recommendations made. Past performance and/or forward-looking statements are never an assurance of future results.

Many of the investments offered will be only available to those investors meeting the definition of an Accredited Investor under SEC Rule 501(A) and offered as Regulation D private placement securities via a Private Placement Memorandum (“PPM”). Prospective investors must receive, read, and understand all the risks associated with buying private placement securities. Investments are not guaranteed or FDIC insured and risks may include but are not limited to illiquidity, no guarantee of income or guarantee that all tax advantages or objectives will be met and complete loss of principal investment could occur.

Risk Disclosure: Alternative investment products, including real estate investments, notes & debentures, hedge funds and private equity, involve a high degree of risk, often engage in leveraging and other speculative investment practices that may increase the risk of investment loss, can be highly illiquid, are not required to provide periodic pricing or valuation information to investors, may involve complex tax structures and delays in distributing important tax information, are not subject to the same regulatory requirements as mutual funds, often charge high fees which may offset any trading profits, and in many cases the underlying investments are not transparent and are known only to the investment manager. Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop. There may be restrictions on transferring interests in any alternative investment. Alternative investment products often execute a substantial portion of their trades on non-U.S. exchanges. Investing in foreign markets may entail risks that differ from those associated with investments in U.S. markets. Additionally, alternative investments often entail commodity trading, which involves substantial risk of loss.

NO OFFER OR SOLICITATION: The contents of this website: (i) do not constitute an offer of securities or a solicitation of an offer to buy of securities, and (ii) may not be relied upon in making an investment decision related to any investment offering by Perch Financial LLC, Arkadios Capital LLC, or any affiliate, or partner thereof. Perch Financial LLC does not warrant the accuracy or completeness of the information contained herein.