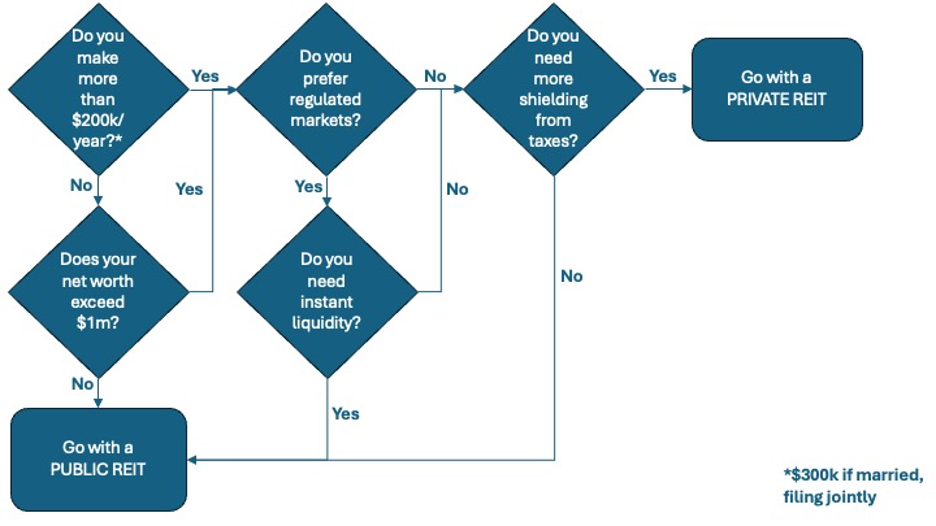

How to choose between public and private REITs: IN ONE PICTURE

Readers of this space have been asking us for some time, “Should I invest in public REITs or private REITs?” As with most investing questions, there’s no one-size-fits-all answer.

So, we did a little research and found that a lot has already been said about this question, and yet the question has never been answered. Not clearly, at least. So, without making you wade through the rest of the text, here’s one graphic that will help you make a clear, rational choice:

As you can see, it’s not a single decision. It’s a cascade of decisions. Now let’s walk through them one at a time.

Do you make enough money?

If you’re reading this, you probably make enough money to qualify as an accredited investor. That is, you make $200,000 or more if you’re single, or $300,000 as a married couple filing jointly. You need at least two years’ history in that range, and this gives you clearance from the Securities and Exchange Commission to buy into opportunities that are not appropriate for most retail investors.

Do you have enough money?

Even if you don’t currently have that kind of reportable income, if your personal net worth – excluding the value of your primary residence – exceeds $1 million, you’re probably still an accredited investor.

Regulation D of the Securities Act of 1933 offers other ways besides income or wealth for an individual to qualify for this distinction but, if you meet these requirements, you’re probably rich anyway. One other criterion involves being an insider of the project seeking the funds, so you’d likely already be personally invested.

Note that the Reg D requirements are joined together by the conjunction “or,” not “and”. As long as you clear any of these hurdles, you’re an accredited investor. And you must be an accredited investor in order to invest in private REITs.

And the buy-ins for private REITs can be high. The Corporate Finance Institute reports minimum investments of up to $100,000 for private issues.

Do you prefer regulated markets?

You can’t be an investor without having at least a little bit of a libertarian streak. But you can’t be prosperous enough to consider private REITs without at least a little bit of motivation to preserve your wealth.

The reason why the SEC requires you to demonstrate wealth or financial sophistication before investing in private REITs is the risk. We’ll talk specifically about liquidity risk next, but all manner of things can go wrong with a big-money bet on real estate. Exposure to economic downturns, realty market crashes are all part of the game.

So are exposures to specific geographies, tenants and properties, but there’s not much to be done about those. This, though, is the biggest substantive difference between public and private REITs. Public ones will tend to diversify portfolios across geographies to tamp down exposure to any one property. Private ones tend to laser-focus on a single development or management opportunity, according to Dividend.com. Because they zoom in like that, private REITs tend to have higher risks associated with such concentration. But with greater risks come, one hopes, greater rewards. As of 2024, public REITs average around 4% dividend yields, while private REITs’ yields can be roughly double that, though potentially with higher risk and less liquidity.

What makes public REITs safer than private ones is that regulators mitigate risks associated with the trades to get in and out of the vehicle, as well as those associated with dodgy management. Regulated markets provide assurance that the transactions proceed smoothly, the custodian is responsible and that the issuer’s financial statements reflect economic reality.

Private REITs wouldn’t be breaking any federal law if they never sent out an audited financial statement, so investors in these organizations take a lot on faith.

Do you need instant liquidity?

If liquidity is an issue for you, a public REIT might be the better choice. Of course, if you’re living paycheck to paycheck, liquidity is a central concern. Still, even wealthy people need cash flow.

Your home is probably your most valuable asset, unless your net worth is truly stratospheric – and even then. It might be a smaller proportion of your net worth, but it’ll still be sizable. But you can’t tip the pizza guy with a shingle. You need some liquid holdings.

And you get that from your investment in securities. That’s why you’re in blue chips, indexes, emerging markets, Treasuries, corporate bonds and munis. If you’re using securities for liquidity, REITs might be the last industry-specific holding to add – and public REITs offer far more flexibility.

If you do want to invest in real estate securities, though, and want to stick to the more liquid end, then public REITs are where you might want to start your search. That’s because they’re exchange-traded, same as stocks. Private REITs, on the other hand, trade among a rarified few market players. If you don’t know someone who wants to buy a position, you might encounter difficulty selling yours. Transaction costs, then, will tend to be higher for private REITs because someone has to act as intermediary.

Moment-to-moment or even month-to-month gyrations of the stock market have little effect on private REITS, a benefit that some say offsets the liquidity risk. This is especially true for long-term, buy-and-hold investors who don’t mind lock-up periods which range from three to 10 years.

Do you need more shielding from taxes?

All REITs have some tax advantages. Dividends may, by default, be taxed at the ordinary rate, but can often be interpreted as business income, which provides a lower effective rate. Since REITs must distribute a minimum 90% of earnings to shareholders each year, this income can be substantial.

When you sell your stake, of course, you would incur either a capital gain or a capital loss. Losses can reduce your taxable income this year, and carry over into future years. Long-term capital gains get taxed at a rate far below that of ordinary income and, as regular readers of this space know, those incurred from real estate transactions can be deferred for a generation.

Private REITs, though, provide even more tax shielding. Depreciation of a private REIT’s properties – assuming that it’s incorporated as an LLC, as is standard – can be passed through to shareholders. They in turn can deduct that depreciation from their adjusted gross income.

At the close

The public and private REIT markets are each trillion-dollar industries, so perhaps the liquidity risk of the private ones might be a little overblown. Still, there are good reasons why only accredited investors can participate.

Before you decide on which sort of REIT is right for you, take a moment and go through the flowchart above. Still unsure which type of REIT fits your goals? Reach out to one of our investment professionals — we’d be happy to walk you through your options.

Disclosures

Not an offer to buy, nor a solicitation to sell securities. Information herein is provided for information purposes only, and should not be relied upon to make an investment decision. All investing involves risk of loss of some or all principal invested. Past performance is not indicative of future results. Speak to your finance and/or tax professional prior to investing.

Real Estate Risk Disclosure:

There is no guarantee that any strategy will be successful or achieve investment objectives including, among other things, profits, distributions, tax benefits, exit strategy, etc.; Potential for property value loss – All real estate investments have the potential to lose value during the life of the investments; Change of tax status – The income stream and depreciation schedule for any investment property may affect the property owner’s income bracket and/or tax status. An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities; Potential for foreclosure – All financed real estate investments have potential for foreclosure; Illiquidity – These assets are commonly offered through private placement offerings and are illiquid securities. There is no secondary market for these investments. Reduction or Elimination of Monthly Cash Flow Distributions – Like any investment in real estate, if a property unexpectedly loses tenants or sustains substantial damage, there is potential for suspension of cash flow distributions; Impact of fees/expenses – Costs associated with the transaction may impact investors’ returns and may outweigh the tax benefits; Stated tax benefits – Any stated tax benefits are not guaranteed and are subject to changes in the tax code. Speak to your tax professional prior to investing.

Securities are offered through Realta Equities, Inc., Member FINRA/SIPC and investment advisory services are offered through Realta Investment Advisors, Inc., co-located at 1201 N. Orange Street, Suite 729, Wilmington, DE 19801. Neither Realta Equities, Inc. nor Realta Investment Advisors, Inc. is affiliated with Perch Wealth.

Realta Wealth is the trade name for the Realta Wealth Companies. The Realta Wealth Companies are Realta Equities, Inc., Realta Investment Advisors, Inc., and Realta Insurance Services, which consist of several affiliated insurance agencies.